Which risk management level refers to situations when time is not a limiting and the right answer is required for a successful mission or task. CCAR loss estimation framework be firmly grounded in the institutions regular operational risk management process.

Principles For The Sound Management Of Operational Risk Analystprep Frm Part 2 Study Notes

One of the most important is one that can be overlooked in the concentration and the glamor of building and designing process and systems.

. Steps of Risk Management. Operational risk includes several other risks such as interest rate liquidity and strategic risk that banks manage and does not lend itself to the management of operational risk per se. To the right are inherent cultural moral and ethical risks.

You can learn more about risks from the following articles. PROCESSES controls transparency documentation. In this example a hedging strategy sold by a.

Condition with the potential to cause injury illness or death of personnel. SYSTEMS downtime security. The management of employee and contractor behavior can become a major source of operational risk.

PEOPLE workload capabilities carelessness fluctuation. Every endeavor entails some risk even processes that are highly optimized will generate risks. Errors caused by employees of the company failure of IT systems fraudulent activities loss of key management people health.

Discussion of the most significant risk factors is provided below. The following are a few examples of operational risk. For the purposes of this Guideline operational risk is defined as the risk of loss resulting from people inadequate or failed internal processes and systems or from external events.

3 Part of decision making. This includes legal risk but excludes strategic and reputational risk. Accept risks only when benefits outweigh cost.

When looking at operational risk management it is important to align it with the. Operational risk can also result from a break down of processes or the management of exceptions that arent handled by standard processes. Damage to or loss of equipment or property.

Here we discuss the top 5 types of operational risks along with examples disadvantages and limitations. Which risk management model establishes a structure for. Shifted to operational risk after greater initial focus on credit and market risk.

Learn vocabulary terms and more with flashcards games and other study tools. Risk Factors in Business. Operational-risk management remains intrinsically difficult and why the effectiveness of the discipline as measured by consumer complaints for example has been disappointing Exhibit 2.

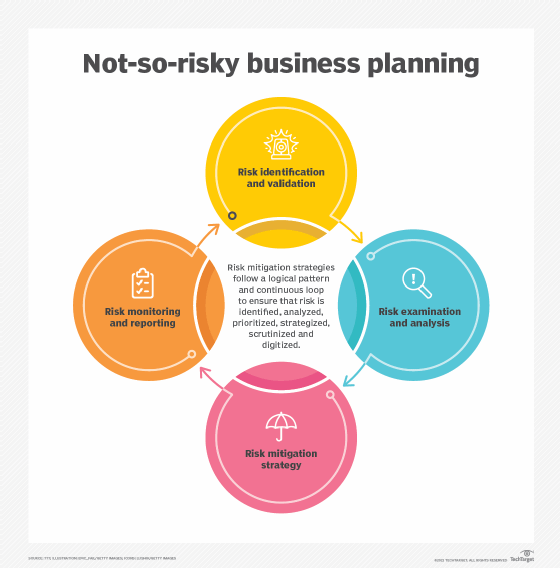

ORM 5-Step Process BAMCISMETT-T. The key risk areas that AngloGold Ashanti believes it is currently exposed to are detailed in the Annual Integrated Report 2011. Risk identification risk analysis risk mitigation and risk monitoring.

4 Inclusive and flexible approach. Over the past few years the Bank has been proactively identifying monitoring and analyzing major risk factors which could affect our financial operations and where necessary has adjusted our organizational structure and risk management processes accordingly. Clearly identified senior management to support own and lead on risk.

Operational risk management is integrated into the BBVA Groups global risk management structure. Risk can be both measurable and quantifiable as well as it can be subjective and qualitative. Business to ensure that proper risk management mechanisms are in place.

McKinsey 2020 Operational Risk Exhibit 1 of 4 Operational-risk losses increased rapidly after the 20089 nancial crisis and have remained elevated since. As part of the revised Basel framework1 the Basel Committee on Banking Supervision set forth the following definition. To establish policy guidelines procedures and.

Types of Bridge Financing. To the left lie ever-present risks from employee conduct third parties data business processes and controls. B130786 Operational Risk Management Operational Risk Management ORM Principles Continued PRINCIPLES OF ORM Accept no unnecessary risk.

2 Integral parts of Organizational process. Start studying Operational Risk Management ORM. Operational risk is inherent to all banking activities products systems and processes.

Operational risk can be found in all parts of the organization and is difficult to define. Credit Risk Modeling Course. Factors considered in the policy.

Operational risk summarizes the uncertainties and hazards a company faces when it attempts to do its day-to-day business activities within a given field or industry. What does Operational Risk Include. That is the people who operated the processes and equipment.

Make risk decisions at the right level. Many factors can influence operational risk. Mark Opausky at BPS describes a scenario that highlights the dangers operational risk can pose in his article Risk Management From Your Desktop.

2 Operational Risk Management ORM Time Critical Risk Management TCRM 3 Operational Risk Management ORM Training Continuum 4 Operational Risk Management ORM Evolution and Program Evaluations 5 Operational Risk Management ORM Glossary 1. Operational risk includes both internal factors and external factors that cause risk. The risk of loss resulting from people includes for example operational risk events relating specifically to internal or external.

An emerging regulatory focusvery much in line with sound day-to-day risk managementis to ensure that the. Tabulated below are the risk management commitments for 2012 that were approved by the Risk and Information Integrity Committee RIIC in November 2011. A type of business risk it.

2013 the operational risk management involves the following steps. Risk management cannot be done in isolation and is fundamentally communicative and consultative. BAMCIS and ORM.

Once the severity of the risk has been established one or more of the following. Which one of the following Risk Management is true. Its origins could be highly diverse processes internal and external fraud technology human resources commercial practices disasters and suppliers.

Develop controls and make risk decisions. Critical success factors in risk management are. Operational riskis defined as the.

As defined in the Basel II text operational risk is the risk of loss resulting from inadequate or failed internal processes people and systems or from external events. Anticipate and manage risk by planning. Organizations in industries face operational risk wherever they turn.

1 Create and Protect Value. Layered on top are technology riskswhich are compounded as organizations embrace new technologies like automation robotics and.

7 Risk Mitigation Strategies To Protect Business Operations

0 Comments